Joint Financial Intelligence Unit

Announcement of the launch of STREAMS 2 on 2026-02-02

Background

The Suspicious Transaction Report and Management System (STREAMS) is currently used by the Joint Financial Intelligence Unit (JFIU) to receive, process and disseminate Suspicious Transaction Reports (STRs). To enhance JFIU’s capability in developing financial intelligence to combat increasingly sophisticated financial crimes, a new platform, named STREAMS 2, has been developed. This platform leverages advanced technologies to enhance system automation and analytical capabilities, thereby enhancing the efficiency and effectiveness of financial intelligence analysis and dissemination.

JFIU are pleased to announce that the development of STREAMS 2 has been completed, with an official launch scheduled for 2 February 2026 (Monday). This announcement outlines the logistic arrangements for the transition from STREAMS to STREAMS 2.

STR Submission Methods for Regulated Entities

Upon the launch of STREAMS 2, regulated entities will no longer be able to submit STRs via email, fax, or post. All STRs must be submitted electronically through STREAMS 2. Under STREAMS 2, regulated entities will have three submission options:-

- Submit STR via XML Submission (Hong Kong Post e-cert is required);

- Upload a completed STR in prescribed PDF format in STREAMS 2 (Hong Kong Post e-cert is required); and

- Complete the STR web-form directly in STREAMS 2.

User Account Registration

For reporting institutions who wish to open STREAMS 2 user accounts, please complete the “STREAMS 2 User Registration Form”, available for download on JFIU website and submit the completed form to JFIU (jfiu@police.gov.hk).

Arrangement for System Transition

To ensure smooth data migration from STREAMS to STREAMS 2, please note the following arrangements:-

- JFIU will stop receiving STR submission at 0000 hours of 2026-01-28 (Wednesday) in STREAMS and will resume receiving STR Submission at 0900 hours on 2026-02-02 (Monday) in STREAMS 2;

- For any urgent information that requires immediate submission of STR to JFIU within the blackout period of STREAMS, please directly approach JFIU via email, phone or fax;

- Upon the launch of STREAMS 2 on 2026-02-02, the operation of STREAMS will be ceased. STR records previously submitted in STREAMS will be migrated to STREAMS 2. Reporting institutions will be able to access these records and view the consent status, if applicable. Nevertheless, reporting institutions are also advised to implement appropriate measures to ensure proper record keeping within their own systems;

- For reporting institutions submitting STR via XML submission or interested in submitting STR via XML submission, please follow the XML schema provided by JFIU under a separate cover and liaise with JFIU as soon as possible for arrangement of technical test to ensure smooth transition.

Enquiries

We are committed to supporting all institutions during this transition. For further enquiries, please feel free to contact hotline 3660 0528 or contact Mr. Owen TSE, Senior Inspector of Police via email at owencytse@police.gov.hk.

Joint Financial Intelligence Unit

Financial Intelligence and Investigation Bureau

January 2026

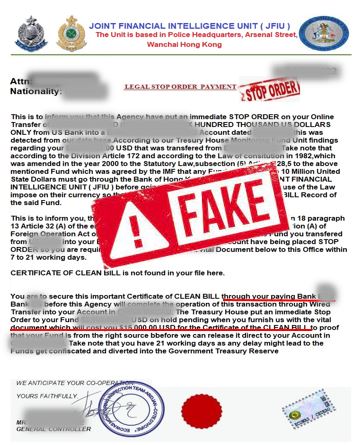

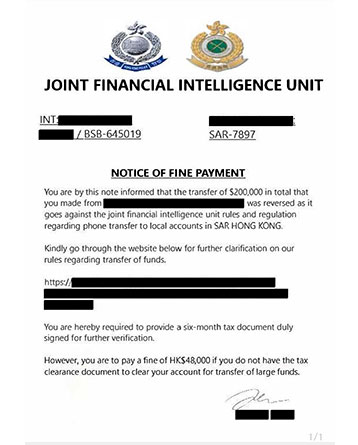

Fraudulent Stop Order and Notice of Fine Payment Purportedly Issued by JFIU

Defrauding Tricks

- Recently, the Joint Financial Intelligence Unit (“JFIU”) received public enquiry over fraudulent stop order and notice of fine payment purportedly issued by JFIU. The order or notice requested the recipient to pay a sum of fee to prove the legitimacy of the remittance that he/she has made, so that the transaction could proceed.

Our Advice

- The JFIU has never issued such order or notice, or any similar order or notice directing recipient to pay for a fee to effect any financial transaction;

- Genuine law enforcement officers will not request you to settle any fees or ask for your online banking account number or password for investigation of cases;

- Even if the scammers are able to provide your personal information or remittance details and send you their law enforcement credentials, it does not necessarily mean that they are genuine law enforcement officers. Scammers can obtain the personal information of the public through open access, security loopholes and even illegal sources;

- Do not disclose your personal information to strangers, including your HKID number, address, online banking accounts and PIN codes;

- Verify the identity of the contact by calling the relevant organisation directly – find them through an independent source such as a phone book or online search. Do not use the contact details provided in the message sent to you;

- Do not click on unknown hyperlinks or input any information;

- Remind your relatives and friends to stay vigilant against deception; and

- If in doubt, please call the “Anti-Scam Helpline 18222” for advice and consider report the matter to the Police.

Welcome to the website of the Joint Financial Intelligence Unit (JFIU) website. The website is designed to provide members of the public in Hong Kong, especially the financial institutions (FIs) including banks, securities and insurance companies, money service operators, money lenders and stored values facility licensees, and the designated non-financial businesses and professions (DNFBP) including legal and accounting professionals, estate agents, trust or company service providers and precious metal and stone dealers, a greater understanding of the laws on money laundering and terrorist financing, and the need to make reports about suspicious transactions.

We hope that any questions which you may have can be answered in the following pages. However, if you need any further information, please feel free to contact JFIU staff. Details of how to contact us can be found in the section Contact Us.

Introduction

It is very important that Hong Kong, as a major financial center maintains an effective anti-money laundering and counter-financing of terrorism regime to safeguard the integrity and stability of our financial system. Money laundering and terrorist financing can have devastating consequences and if we do not put in place proper countermeasures in accordance with international standards, the risk of criminals using Hong Kong for their illicit funds and illegal activities will increase. Hong Kong must guard against such a situation that would adversely affect all our livelihoods.

Anti-money laundering and counter-financing of terrorism is everyone’s responsibility. When you come across any property, which you know or suspect to be drug or crime proceeds or terrorist property, you should make a suspicious transaction report (STR) to the JFIU.

Failing to report knowledge or suspicion of crime proceeds or terrorist property is a criminal offense, which carries a maximum penalty of a fine at level 5 and imprisonment for 3 months' imprisonment.